Knowing that the Internal Revenue Service is constantly adapting to the changing landscape of tax regulations, we hope to best serve you, the taxpayer, by providing a comprehensive update covering the latest IRS updates and changes. Continue reading to learn if any of them apply to you!

Latest Updates:

IRS Ends Unannounced Revenue Office Visits to Taxpayers

Except for very unique circumstances, the IRS has declared that unannounced visits to taxpayers by agency revenue officers will no longer occur in an effort to reduce public confusion and increase safety.

Misleading Employee Retention Credit Scams

Despite the legitimacy of the Employee Retention Credit (ERC), taxpayers should be aware that promoters have been using marketing tactics such as broadcast advertising, mail solicitations, and online promotions to mislead taxpayers into thinking they can qualify for this tax credit.

Direct File Report to Congress

The IRS is looking into a more convenient method for taxpayers to file their taxes. The new method would allow for a Direct File option in which the system would offer taxpayers a free, voluntary, IRS-run electronic filing platform to submit their taxes.

Steps are being taken for a pilot of the system to be introduced for the 2024 filing season.

Inflation Reduction Act Strategic Operating Plan

The IRS has introduced a new strategic operating plan meant to improve the way the agency serves taxpayers and the nation. The plan aims to make these substantial changes over the next decade and is funded by the Inflation Reduction Act from last year.

2023 Tax Inflation Adjustments

The 2023 tax year will see annual inflation adjustments for over 60 tax provisions. Tax rate schedules will be affected. Taxpayers should review how these changes will affect their tax liability and deductions.

For a detailed list of the adjustments being made, see Revenue Procedure 2022-38. It is important to stay up-to-date with the latest tax rates.

2023 Standard Mileage Rates

Effective January 1, 2023, the standard mileage rate used to calculate the operating cost for cars, vans, pickups, and panel trucks is 65.5 cents per mile for business use. This is an increase of 3 cents per mile.

This change is important for individuals and businesses that rely on vehicles for work-related purposes and will have a significant impact on mileage-related deductions come tax time.

Filing Your Taxes This Year

Missed the Filing Deadline

If you missed the April 18 filing deadline, it is very important to file your taxes as soon as possible. Missing the deadline without requesting an extension will result in penalties and interest, but filing sooner rather than later will limit this to a minimum. If you are struggling to pay your tax bill, there are options available to you.

Disaster Tax Relief

If you are a taxpayer living in a disaster-area, you may be receiving tax relief extensions. Taxpayers in parts of California, Alabama, and Georgia, as well as those affected by Typhoon Maawar in Guam and the Commonwealth of the Northern Mariana Islands, have been granted extensions to file their tax returns.

Additionally, victims of storms and natural disasters in Arkansas, Indiana, Mississippi, and Tennessee will also be given additional time to meet their tax obligations.

State Payments

Certain states have determined that taxpayers will not need to report special payments on their tax returns. For a list of the states not requiring special payments to be reported, see this link.

The link provided also details what constitutes a special payment.

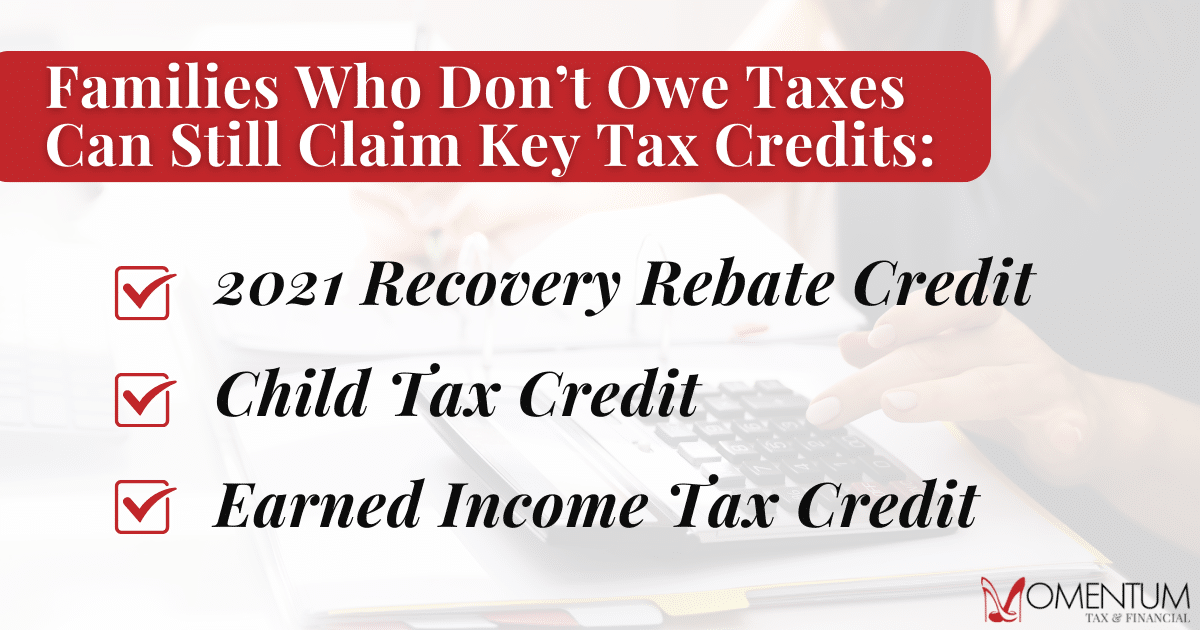

Families Who Don’t Owe Taxes Can Still Claim Key Tax Credits

The IRS sent a letter to 9 million individuals and families that qualify for several key tax benefits from 2021. If you have not yet claimed these tax benefits, there is still time.

If eligible, you may file your 2021 tax return and without penalty, claim the:

- 2021 Recovery Rebate Credit

- Child Tax Credit

- Earned Income Tax Credit

Puerto Rico Families Can Claim the Child Tax Credit

Families with children in Puerto Rico who do not owe taxes to the IRS can still file their 2021 tax return until April 15, 2025. Families will be eligible to claim $3,600 per child via the Child Tax Credit without penalty.

Tax Credits for Families Revert to 2019 Levels

The Child Tax Credit (CTC), the Earned Income Tax Credit (EITC), and the Child and Dependent Care Credit amounts are going back to pre-COVID levels. Expect to receive a smaller refund compared to last year.

Premium Tax Credit Expanded

The premium tax credit (PTC) is a refundable credit that helps eligible individuals and families cover health insurance premiums for health insurance purchased through the Health Insurance Marketplace.

In order to qualify, you must meet an income requirement and other eligibility information can be found here.

Form 1099-K Lower Reporting Threshold Effective 2023

Starting in 2023, taxpayers who receive more than $600 for goods and services by way of payment apps or online marketplaces may receive a Form 1099-K. If you or your business is engaged in online commerce, this will be a change to take note of.

More information on Form 1099-K can be found here.

Stimulus Payments

Unlike 2020 and 2021, there are no new stimulus payments for 2022. Taxpayers should not expect additional direct payments from the government this year.

No Above-the-Line Charitable Deductions

Taxpayers were previously able to claim up to $600 charitable donation tax deductions during the COVID pandemic. However, this will not be the case for this tax year. Taxpayers who take the standard deduction and do not itemize their deductions will not be eligible to deduct charitable contributions on their tax returns.

Paycheck Protection Program (PPP) Loans Improperly Forgiven are Taxable

It is critical for individuals and businesses that received Paycheck Protection Program (PPP) loans to be aware that if the loan forgiveness was based on a misrepresentation or an omission, the forgiven amount must be included in income on your taxes.

If you think this may apply to you, this pdf will be helpful.

Reach Out to Momentum.tax to See How These Apply to You

At Momentum.tax, we understand that changes made by the IRS can be difficult to keep up with for the average taxpayer. If you need help understanding these changes and how they impact you, your business, or your tax return, please reach out to us. We are always happy to help!