As a business owner, one of your responsibilities is to manage your tax obligations but implementing tax strategies for business owners can be overwhelming.

However, with the help of tax planning, you can implement strong tax strategies.

Implementing Tax Strategies for Business Owners Requires a Tax Plan

Tax planning is a crucial aspect of managing a business and should be done all year round. A tax plan allows you to identify various tax-saving strategies that can be implemented throughout the year and the goal is to minimize tax liability, maximize tax deductions, and avoid penalties.

A tax plan should be developed by a professional accountant or a tax expert with experience in tax planning and it should consider the unique circumstances of your business, such as your income, expenses, and potential tax liabilities.

By developing a tax plan, you can identify the strategies that will work best for your business and help you save money on taxes.

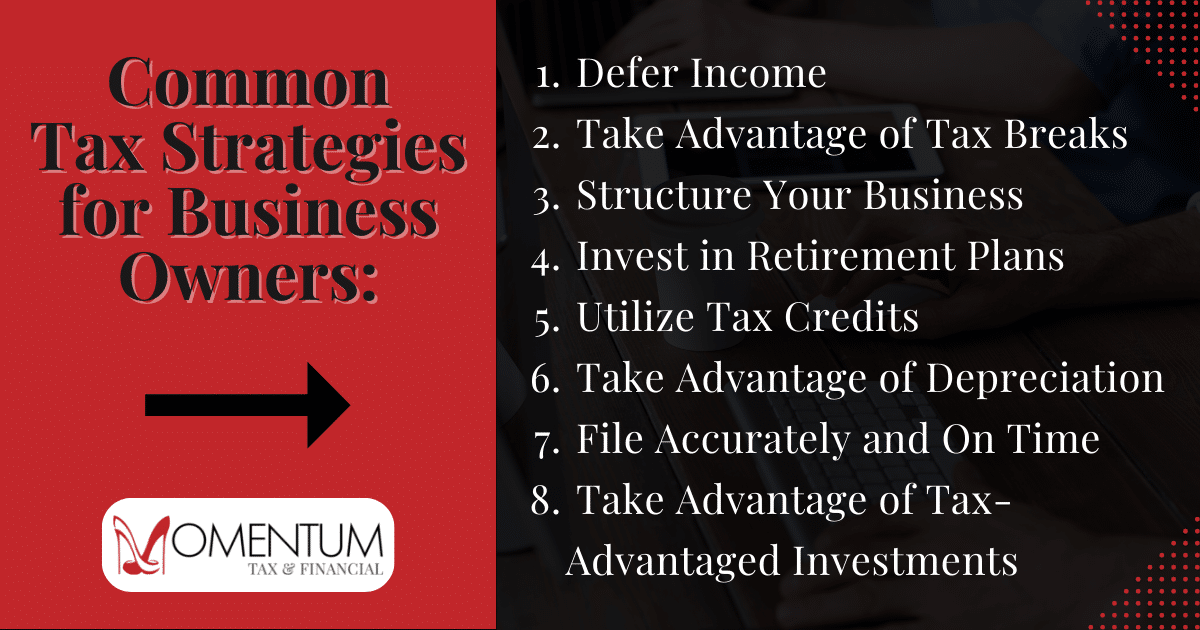

Common Tax Strategies for Business Owners

1. Defer Income

One of the most straightforward strategies is to defer income to a later tax year. Doing this can reduce your overall tax burden, especially if your tax rate is lower in the following year.

For example, delaying invoicing until January can help reduce your taxable income for the current year, which may be beneficial in some years and not in others.

2. Take Advantage of Tax Breaks

Tax breaks are deductions for business expenses that can be used to reduce your tax liability.

As a business owner, you can take advantage of various tax breaks, such as deductions for:

- Home office expenses

- Mileage

- Business start-up costs

- Other business-related expenses

To ensure you’re eligible to claim applicable deductions and reduce your taxable income, keep accurate records of your business expenses throughout the year.

3. Structure Your Business

Choosing the right business structure is essential for minimizing your tax burden as different structures have different tax implications.

For example, a sole proprietorship is the simplest structure but is subject to self-employment tax. An LLC or corporation can provide liability protection and potentially lower tax rates.

It’s important to talk with an experienced accountant and weigh your options.

4. Invest in Retirement Plans

Investing in a retirement plan is a tax-effective way to reduce your taxable income.

Retirement plans such as an IRA or a 401(k) allow you to make contributions to your retirement account as well as deduct that amount from your taxable income. By investing in a retirement plan, you can reduce your taxable income (and defer it until you are in a lower tax bracket) and save for retirement at the same time.

5. Utilize Tax Credits

Tax credits are another effective way to reduce your tax liability. As a business owner, you can take advantage of various tax credits, such as research and development or paying for your employee’s childcare costs. By identifying the tax credits that apply to your business, you can reduce your tax liability and, in some cases, receive a refund.

Note: The difference between tax deductions and tax credits is that deductions reduce the amount of income before you calculate the tax you owe, while credits reduce the amount of tax you owe or increase your tax refund.

6. Take Advantage of Depreciation

Depreciation is a tax deduction that allows you to recover the cost of business-related assets over time, such as office furniture, vehicles, or computers.

By taking advantage of depreciation, you can reduce your taxable income and save money on taxes. It’s important to keep accurate records of your business-related assets and claim depreciation deductions on your tax returns.

7. File Accurately and On Time

Filing accurate and timely tax returns is crucial to avoid penalties and interest charges.

By filing your tax returns on time, you can avoid late-filing penalties and ensure that your tax obligations are met. It’s important to keep accurate records of your income and expenses throughout the year to make the tax-filing process as smooth as possible.

8. Take Advantage of Tax-Advantaged Investments

Tax-advantaged investments provide tax benefits, such as tax exemption or deferral. For example, investing in a retirement account, such as a 401k, allows you to defer tax to a later date when you are, as mentioned before, potentially in a lower tax bracket.

Partner with an Accountant to Optimize Your Tax Strategies

Partnering with an accountant will help you stay on top of your finances throughout the year. A good accountant will not only help you with tax planning and strategizing, but they will also assist with record-keeping, claiming deductions, and filing your taxes accurately and on time.

At Momentum.tax, we specialize in working with business owners to optimize their tax strategies and save them money.

Our team of experienced accountants will work with you throughout the year to develop and implement a tax plan with tax strategies tailored to your unique needs and goals. Contact us today to schedule a consultation and learn how we can help you save money on your taxes.