Hey there, money maestros and financial aficionados! If you’re someone who loves a good tax credit and is also passionate about greener living, you’re in for a treat! In 2023, the government revved up support for electric vehicles, giving you even more reasons to make the switch to a clean, green driving machine today!

Electric vehicles purchased in 2023 can qualify for up to $7,500 in tax credits to offset your 2023 tax liabilities! The credit cannot be refunded or carried forward, so you’ll want to make sure you’ll have $7,500 in tax liability, in order to take advantage of the full credit.

Zooming into Federal Electric Vehicle Credits

The sale of the vehicle qualifies if it meets the following criteria:

- The vehicle must be purchased new. In order to qualify, new in this case means it has not previously been purchased, registered, titled, or used for any purpose.

- At the time of sale, the seller is required to submit your name and taxpayer identification number to the IRS for you to be eligible to claim the EV credit.

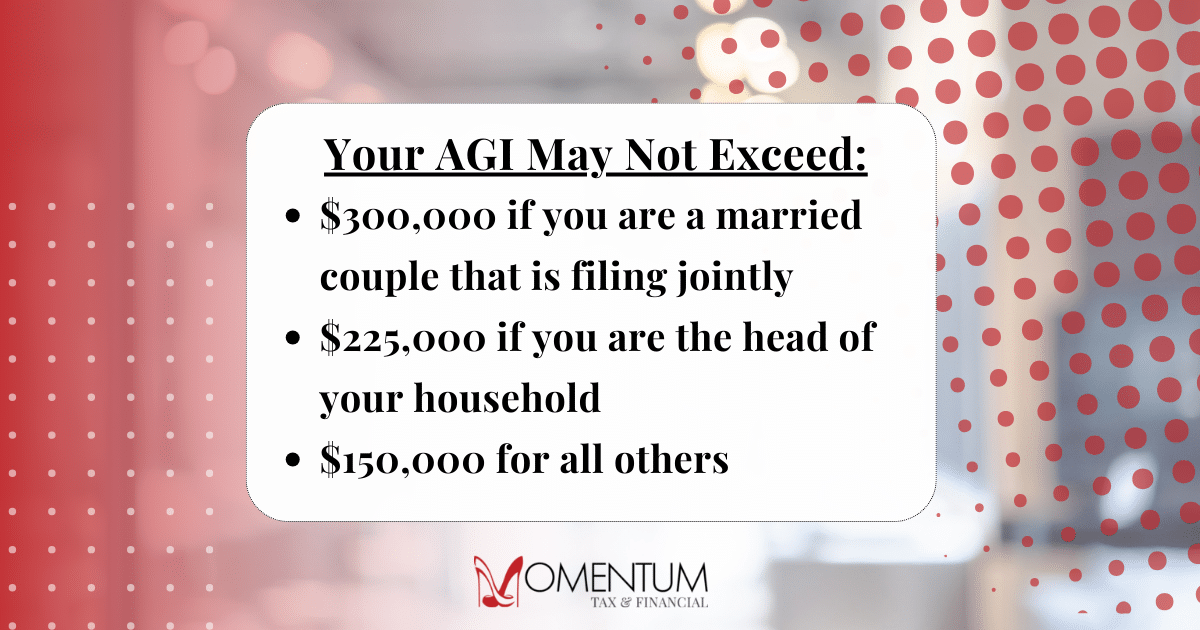

In addition, your modified adjusted gross income (AGI) for the year of purchase or the prior year may not exceed:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

More specifics can be found here.

What Vehicles Qualify for the Electric Vehicle Credits in 2023?

To qualify, the vehicle must meet specific criteria, check out current qualifying vehicles here.

Colorado: Where the Mountains Aren’t the Only Thing High!

The Centennial State is offering a smorgasbord of tax credits, rebates, and incentives for EV owners. Picture this: cruising through the Rockies in your emission-free ride, all while enjoying the financial perks that come with it. It’s a win-win!

EV Tax Credit (Requirements): To qualify for Colorado’s EV tax credit, your vehicle must be new, comply with emissions standards, and be purchased or leased for at least 24 months. So, no dusting off that vintage electric golf cart in the garage just yet!

- $5,000 refundable tax credit

- Titled and registered in Colorado

- Vehicles eligible for the Colorado Innovative Motor Vehicle Credit can be viewed here.

Navigating the Electric Highway?

As you embark on this electric journey, it’s essential to stay informed and make the most of these credits. Consult with your favorite number crunchers (ahem, your friendly neighborhood accounting firm) to ensure you’re maximizing your savings and staying on the right financial track.

Remember, going green isn’t just good for the environment; it’s fantastic for your bank account too. So, buckle up, charge up, and let’s ride into a greener, financially brighter future together!

Disclaimer: This blog post is for informational purposes only and does not constitute tax advice. Always consult with a qualified professional for personalized guidance based on your specific situation. Happy driving! 🚗⚡💸